39 ab trust diagram

What is a Disclaimer Trust? - The Pollock Firm LLC A Disclaimer Trust is a special type of trust often created under a Will (or as a sub-trust of a revocable living trust).In order to understand Disclaimer Trusts, you first need to understand what a disclaimer is and what happens when you make a disclaimer so that you can understand the purpose and mechanics of Disclaimer Trusts. In the diagram, ab = 10 and ac = . what is the perimeter ... In the diagram, ab = 10 and ac = . what is the perimeter of abc? 10 units 10 + units 20 units 20 + units. by soetrust January 4, 2022 Leave a reply 18. Gamers!!! Amazon Luna launches with freebies for Prime subscribers. Amazon Luna special offer for Prime members! Try Amazon Luna Now!!

What Is an AB Trust? - The Money Alert What Is an ABC Trust (Diagram)? An ABC Trust is similar to an AB trust, but instead of two individual trusts, the trust is divided into three shares upon the first spouse's death. These shares are called an "A Trust," "B Trust," and "C Trust."

Ab trust diagram

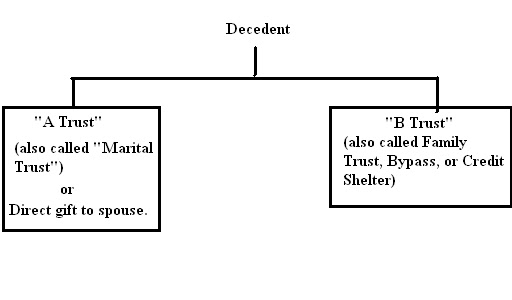

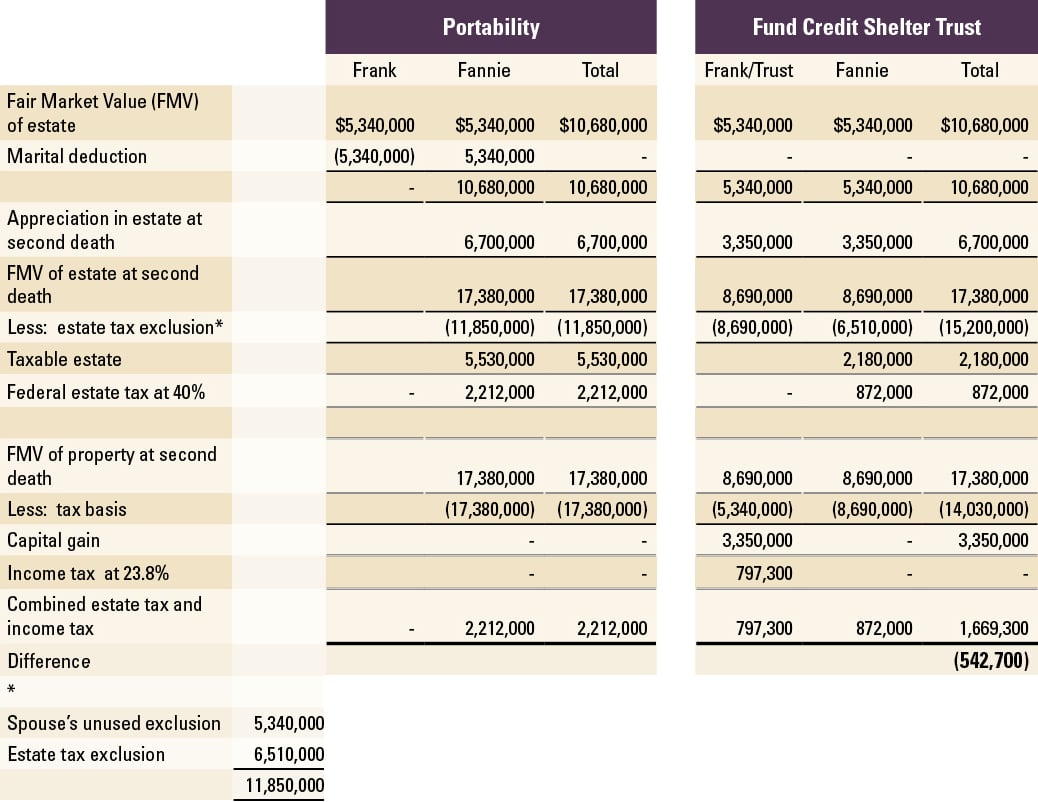

A-B Trust - Overview, Purpose, How It Works, Advantages An A-B Trust is structured to maximize the tax exemption of both spouses' estates. Below is a diagram that provides an overview to explain how an A-B Trust works: Explanation 1. Married couples include the appropriate A-B Trust language in their last will and testaments or revocable living trusts with the assistance of an estate planning attorney . Terminating a Deceased Spouse's Bypass Trust — Drobny Law ... The gold standard for spouses preparing a Revocable Living Trust after 1981 was what has generally become known as the AB or ABC Trust. That allowed each spouse to take advantage of the Exemption Equivalent Amount from Federal Estate Taxes. Starting in 1981, that Exemption Equivalent was going to slowly work its way up to $600,000. Tax-Saving AB Trusts - Nolo An AB trust, or bypass trust, may help some couples avoid estate tax. Wealthy married couples get a big tax break when it comes to the federal gift/estate tax. Together, they can transfer over $24 million without owing federal gift tax or estate tax. This ability to combine each spouse's individual estate tax exemption is called (by tax lawyers ...

Ab trust diagram. What is an AB Trust? | legalzoom.com An AB trust is a joint trust set up by a husband and wife that controls how their property is distributed after each of their deaths. The trust allows avoidance of estate tax when the first spouse dies. How a Bypass Trust Works In an Estate Plan - SmartAsset A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away. When one spouse dies, the estate's assets are split into two separate trusts. The first part is the marital trust, or "A" trust. The second is a bypass, family or "B" trust. PDF Is the "Clayton Election" a Good Choice for Your Estate Plan? traditional split trust, is that the surviving spouse will make a "Clayton Election" at the first death, provided for in the trust document, directing that the deceased spouse's assets be allocated as a QTIP Marital Trust, with the result that the assets of this trust will be included in the surviving spouse's estate for PDF AB Disclaimer Trust: Is It For You? - TrustAdvice.com (EDS) covers only the B trust in both the AB and ABC Trust. Figure 1: AB and ABC Trust Diagram The following statements are true about the A trust. 1. The A trust is revocable, and the surviving spouse has the power to change everything. 2. The surviving spouse can spend the A Trust assets without restriction, for anything desired.

Estate Planning Part III - Bypass Trusts | CPA Practice ... Especially for blended families, the AB Trust can be a critical estate planning tool. At the death of the first spouse, their assets are split among the Family, or "B" Trust and the Survivor ... What Is an AB Trust in an Estate Plan? - The Balance The AB Trust system can be set up under the couples' Last Will and Testaments or Revocable Living Trusts. The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust." ABC Trust Flow Chart - lataxlawattorney.com This type of trust begins as a single Revocable Trust. When the first of the Settlors dies, the Trust is divided into sub-trusts. For example, an AB Trust divides into the "Survivor's Trust" and the "Decedent's Trust" (or "Credit Shelter Trust"). The Survivor's Trust remains revocable and contains the surviving Settlor's property interest. The ABC Trust System of Estate Planning When planning to reduce federal estate taxes, married couples can make use of the AB Trust system in their estate planning. The AB Trust is set up in such a way that they can effectively transfer two times the maximum federal estate tax exemption to their heirs without encountering federal estate tax penalties. However, in states that collect separate estate tax, traditional AB Trust planning ...

A-B Trust Definition - Investopedia An A-B trust is a joint trust created by a married couple for the purpose of minimizing estate taxes. It is formed with each spouse placing assets in the trust and naming as the final beneficiary... The Problems & Disadvantages of the Outdated AB Trust ... This presentation is about the major problems, headaches, tax costs, outdating, and other significant disadvantages of the now outdated AB trust -- and how i... Sample Allocation Agreement For The Revocable Trust Of ... 1. Division of Family Trust Estate into Shares. Very Rich Person ("Decedent"), died on February 25, 2009. The Trust provides that, on Decedent's death, the Trustee shall divide the trust estate into three separate trusts: a Survivor's Trust, a Marital QTIP Trust and a Family Bypass Trust. The separate trusts shall contain the following: a. ABC Trust Diagram Archives - The Money Alert What Is an AB Trust? Estate Planning. What Does an Estate Planning Attorney Do? What Is a Trust Fund and How Does It Work? What is a Revocable Living Trust? ... Tag: ABC Trust Diagram. What Is an AB Trust? Alaina Sullivan-September 10, 2018. 0. MOST POPULAR. 2nd Quarter 2007 Newsletter. June 29, 2018. Weekly Stock Market Commentary 1 26 2009.

Estate Planning Templates - SmartDraw Estate Planning Mind Map. Edit this example. Basic Elements of an Effective Estate Plan. Edit this example. Basic Estate Planning - AB Trust. Edit this example. Handling a Conservatorship. Edit this example. Probate, and Living Trust Asset Transfer Comparison.

PDF Disclaimer and Bypass Trusts Explained - Anne Marie Segal A bypass trust structure often consists of two trusts, commonly called an A/B Trust, in which the federal exclusion amount funds the B Trust and the rest passes to the spouse in an A Trust or directly. Disclaimer Trusts. With a disclaimer trust, a surviving spouse must affirmatively make a timely election to create an A/B or other Trust structure.

Beware: Your Estate May Contain an Unnecessary Bypass Trust A bypass trust (also called an "A/B trust" or a "credit shelter trust") was designed to prevent the estate of the surviving spouse from having to pay estate tax. The standard in estate tax planning was to split an estate that was over the prevailing state or federal exemption amount between spouses and for each spouse to execute a trust to ...

PDF A Guide to Living Trusts - LegalZoom An AB living trust is a trust that does not allow the terms of the trust regarding the property of the first grantor to pass away to be changed after his or her death. This type of trust is often created by blended families. Both types of trusts have estate tax savings

Do you really need that AB Trust? Benefits of Simplicity ... As an example, Bill and Betty own real property in California and have an AB trust design. Bill died in 2013, at which time Bill and Betty's combined community property estate was $7,000,000. The bypass trust was funded with $3,500,000 in real property, and the survivor's trust was funded with $3,500,000 in real and personal property.

AB Trusts - An "Everything You Need to Know" Guide | Trust ... An AB Trust is a Trust created by married couples to help minimize estate taxes for the surviving spouse after one spouse passes away. This joint Trust allows the estate to be split into two parts (or Trusts) after the death of a spouse, and then be taxed accordingly. The purpose of AB Trusts is to help avoid double taxation and ensure that ...

Basic Estate Planning - AB Trust - SmartDraw Text in this Example: Estate Valued at: $2,850,000 Balance of Assets, $1,350,000 to "A" Trust $1,500,000 to Estate Tax Exempt "B" Trust Basic Estate Planning - A/B Trust 1. Estate is Valued 2. Estate Tax Return is filed. 3. Trust "B" is funded. As of 2004, this trust may be funded up to the amount sheltered by an estate tax credit, which is $1.5 million.

Chords for Brent Faiyaz - Trust (Lyrics) [Eb Bb C Ab Db Fm Ebm Bbm Cm F Gm] Chords for Brent Faiyaz - Trust (Lyrics) with song key, BPM, capo transposer, play along with guitar, piano, ukulele & mandolin.

QTIP Trust vs Bypass Trust: Which Do You Need? | Los ... Another common choice married couples can consider is the bypass trust, also known as an AB trust. With a bypass trust, there are three separate trusts created upon the death of the first spouse. One trust, the A trust, is created for the surviving spouse. The family trust, or B trust and a QTIP trust are also created.

Do You Still Need Your AB Trust? | Nolo Trust tax returns. The irrevocable trust is a separate, tax-paying entity. The surviving spouse must get a taxpayer ID number for it and file an annual trust income tax return. Recordkeeping. The surviving spouse must keep separate records for the irrevocable trust property. How to Revoke an AB Trust

A/B/C/ Trust | Q-Tip Trust | California Estate Planning ... The benefit of an A/B/C Trust as opposed to an A and B Trust is that the A/B/C Trust not only divides the decedent's assets from the survivor's assets; but further divides the decedent's assets between those with a total value up to the exemption from estate tax and the growth on those assets; and, the decedent's assets over and above the ...

Tax-Saving AB Trusts - Nolo An AB trust, or bypass trust, may help some couples avoid estate tax. Wealthy married couples get a big tax break when it comes to the federal gift/estate tax. Together, they can transfer over $24 million without owing federal gift tax or estate tax. This ability to combine each spouse's individual estate tax exemption is called (by tax lawyers ...

Terminating a Deceased Spouse's Bypass Trust — Drobny Law ... The gold standard for spouses preparing a Revocable Living Trust after 1981 was what has generally become known as the AB or ABC Trust. That allowed each spouse to take advantage of the Exemption Equivalent Amount from Federal Estate Taxes. Starting in 1981, that Exemption Equivalent was going to slowly work its way up to $600,000.

A-B Trust - Overview, Purpose, How It Works, Advantages An A-B Trust is structured to maximize the tax exemption of both spouses' estates. Below is a diagram that provides an overview to explain how an A-B Trust works: Explanation 1. Married couples include the appropriate A-B Trust language in their last will and testaments or revocable living trusts with the assistance of an estate planning attorney .

![PDF] Social Categorization and the Perception of Groups and ...](https://d3i71xaburhd42.cloudfront.net/c5828a6d99eddb9df886dfbf62a841580926ab70/8-Figure1-1.png)

/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

Comments

Post a Comment